Introduction

Pricing your home right is one of the most crucial decisions you’ll make when it comes to selling your Fayetteville home. Because of things like Fort Bragg, military moves, and the way neighborhoods work, the Fayetteville housing market is unique and needs a custom pricing plan to make sure it sells. You could leave your home on the market for months or sell it for less than it’s worth if you set the price too high or too low.

This guide will show you the important steps you need to take to understand Fayetteville’s specific market conditions, learn how to do a Comparative Market Analysis (CMA), and set prices that will get you the right buyers. If you set the price right, you’ll not only get serious buyers, but you’ll also get the most out of your home and sell it faster.

To price your home correctly, you need to do more than just pick a number. You also need to know what buyers in Fayetteville are actively looking for and make sure your pricing plan is in line with that. By the end of this guide, you’ll know how to price your home in the Fayetteville market so that it sells quickly and for the best price.

This home selling guide is prepared by professional home buyers from Cardinal House Buyers

Understanding Fayetteville’s Real Estate Market

Understanding the local market factors in Fayetteville is essential for pricing your home right when selling. There are a few important things that make Fayetteville’s real estate market special that people should think about before setting a price. These things affect not only how much a house is worth, but also how you should market it when you want to sell it.

Impact of Fort Bragg on Pricing Your Home Right

Fort Bragg, which is one of the largest military bases in the U.S., is a big part of what makes the Fayetteville real estate market go. This military hub has a big effect on the market for both rental homes and homes for sale. A lot of military people move to and from Fayetteville, which means there are always people looking to buy homes, especially in areas near Fort Bragg. Therefore, pricing your home right in Fayetteville entails being aware of how the military affects the market and being aware of how to meet the needs of these buyers.

People often want to buy homes near Fort Bragg, especially ones with big yards or enough room for families. If you price your home too high in these places, you might not get as many showings. On the other hand, if you price it right, you can get military families who want to move quickly. Pricing your home right is crucial for homeowners in places like Spring Lake or close to base gates to take advantage of this ongoing demand.

Neighborhood Differences in Fayetteville

There are many neighborhoods in Fayetteville, and each one has its own unique attraction. Pricing your home right means adjusting your asking price based on the unique features of your neighborhood, whether you’re selling a house in the historic Haymount district, the more suburban areas of Terry Sanford, or close to the busy downtown area. Homes in more established neighborhoods, like Haymount, may be worth more because they are close to shops, schools, and parks. For newer developments or homes in places that are becoming more popular, on the other hand, you may need to set your prices more competitively to get people to buy them.

Pricing your home right can be significantly influenced by the type of neighborhood you live in and how close it is to things like schools, shopping areas, and parks. Knowing these differences will help you set the right price for your home, whether you live in a neighborhood that needs more strategic pricing to bring in the right people or one that is in high demand.

Buyer Demographics and Their Impact on Pricing

A lot of different types of people buy homes in Fayetteville, including military families, first-time buyers, and retired. There are different wants and needs for each group, which can affect the price of the home. Military buyers often look for homes that are ready to move into and have places that can be used in different ways to fit their needs. First-time buyers, on the other hand, may care more about how much the home costs and whether it can be improved in the future. This could change how you set your prices.

To set the right price for your home, you need to know what these buyers want. For instance, military families might be ready to pay more for a house with a big yard or extra bedrooms to meet their needs. For first-time buyers, on the other hand, lower prices and fewer high-end options may be more important. By making your price fit the needs of the people you want to buy your home, you can get it sold faster and for more than it’s worth.

Comparative Market Analysis (CMA) in Fayetteville

A Comparative Market Analysis (CMA) is one of the most effective tools available to you when it comes to pricing your home right. A CMA is a detailed look at similar homes in Fayetteville that have recently sold or are on the market right now. If you know how your home stacks up against others in the area, you can set a reasonable selling price that will get people interested and keep you from losing money.

What is a CMA and Why Pricing Your Home Right is Essential

A CMA tells you what price range your home is most likely to sell for. Setting the right price for your home is very important, because if you do it wrong—either too high or too low—you might not be able to sell quickly or at the best price. If you use a CMA, you’ll have the most up-to-date, specific information to help you make a choice.

How to Perform a CMA in Fayetteville

Find homes that are similar to yours in size, age, state, and location if you want to do a good CMA. How to do it is as follows:

Choose Homes That Are Similar: Look for homes in your Fayetteville neighborhood or nearby that are similar in size, number of bedrooms and bathrooms, and other important features. For instance, if your house is close to Fort Bragg, look at other houses in the same area that military families like.

Look at Homes That Have Recently Sold: Look at homes that have sold in the last three to six months. This time frame gives you the most true picture of how the Fayetteville market is doing right now and how buyers are acting. But remember that the market can change, so it’s also important to look at the bigger picture of the economy.

Check out the active listings. The competition can be seen in the active postings. The owners or agents of these homes set the prices based on what they think the Fayetteville market is worth. Look at their features and make changes based on what you find.

Look at expired listings. Homes that didn’t sell are just as useful for figuring out prices. If a house was priced too high and didn’t sell, you should learn from this so you don’t do it to your own home.

Key CMA Factors to Consider for Pricing Your Home Right in Fayetteville

The place is Different Fayetteville areas can have a big effect on how much a house is worth. Homes near Fort Bragg or downtown Fayetteville may sell for more because people want to live there.

Size and Condition of the Home: Homes that are bigger, better taken care of, and in better neighborhoods tend to sell for more money. If you’ve updated your kitchen or bathroom or put in new flooring, your home will be worth more than similar houses that haven’t been updated.

The state of the market: How you price your home can depend a lot on the Fayetteville real estate market, like whether it’s a buyer’s or seller’s market. Understanding these factors will assist you in pricing your home right to draw in the right customers.

Using a CMA to Price Your Home Competitively

The main point of a CMA is to help you set a price that is fair and competitive in today’s market. The key to setting the right price for your home is to find the sweet spot where it stands out without being too expensive. If you set your price too high, people might not want to buy, and if you set it too low, you might miss out on money.

Using a CMA to help you set the right price for your home will help you make sure you’re not cheating yourself and accurately reflecting its value. It also gives you a clear standard against which to judge any offers that come your way, making sure you get the best deal in the Fayetteville market.

Factors Affecting Home Pricing in Fayetteville

Understanding the different things that affect home prices is essential when it comes to pricing your home right in Fayetteville. The home market in Fayetteville is one of a kind because it has a wide range of buyers and is shaped by the area. How much you should price your home to get the best buyers and the fastest sale depends on a number of important factors.

Home Condition and Age

Pricing your home right depends a lot on the state of its interior and exterior. When setting a price, you may need to pay extra attention to older homes, especially in established areas like Haymount and Downtown Fayetteville. Homes that have been well taken care of or that have recently been renovated usually sell for more money. If your house is old or needs a lot of work, you might need to lower the price you’re asking to reflect that. In Fayetteville’s competitive market, homes that have been updated with modern features, are energy-efficient, and look good from the outside may command a higher price.

Property Features and Upgrades

The features and improvements you make to your home have a direct effect on its value. In Fayetteville, buyers are especially interested in homes with big yards, modern kitchens, multiple bedrooms, or home offices. People who are military families or buying their first home often look for certain features, like extra living room, lots of storage, or a finished basement. Consider the importance of these features when pricing your home right, and change your asking price to match what the market will pay for them. You can also add a lot of value to your home by making changes like installing new appliances, hardwood floors, or energy-efficient windows.

Neighborhood and Location

There are many neighborhoods in Fayetteville, and each one is good for a different kind of buyer. To set the right price for your home, you need to know a lot about how location changes property value. For instance, homes near Fort Bragg may be in higher demand because of the large military population, while homes in the city’s historic areas may attract buyers who want something with a lot of charm and character. Families, on the other hand, might like areas in the suburbs with great schools and parks more. You can price your home competitively and get the right buyers by looking at similar homes in the area and learning what buyers want in that area.

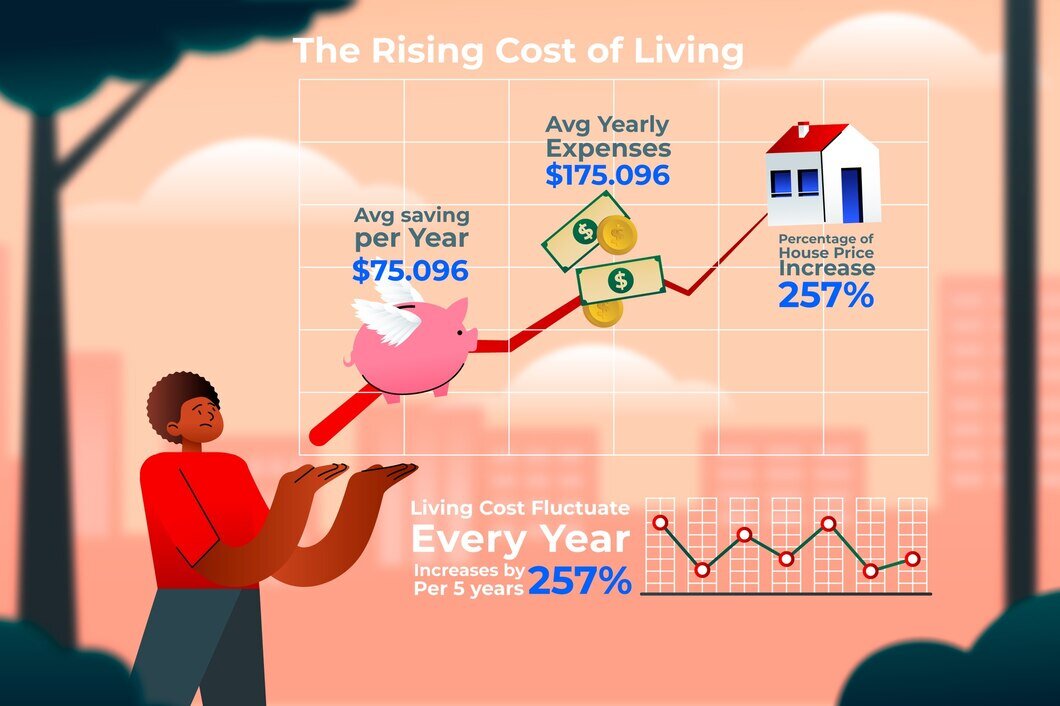

Seasonal Market Fluctuations

Like housing markets in many other places, Fayetteville’s goes through yearly changes that can affect home prices. A lot of people buy homes in the spring and summer, especially military families who want to move. If you price your home correctly during these busy times, you might be able to take advantage of the higher demand. On the other hand, there aren’t as many sellers in the fall and winter, so prices may need to be more competitive to get people interested. If you’re selling your home during the off-season, you might get more attention and see it sold faster if you price it a little lower.

Local Economic Conditions

Pricing your home right is directly influenced by the state of the economy in Fayetteville and the market as a whole. Interest rates, job market trends, and changes in local businesses can all affect a buyer’s ability to buy something. For instance, if loan rates go up, buyers might be less likely to buy, which could have an effect on home prices. It’s important to know about the local economy in order to set a price that meets the needs and demands of buyers. If any of these things change, you may need to make changes to your home prices to stay competitive.

Buyer Demographics

People who buy homes in Fayetteville include military families, retirees, and people who are buying their first home. Each of these groups has different needs and wants when it comes to the features and price of a home. For instance, military families may want to live close to Fort Bragg, while retirees may be more interested in homes that don’t need much upkeep or homes in quieter suburbs. To price your home correctly, you need to know what these groups of buyers want and then adjust your pricing plan to meet those needs. You can set a price that appeals to your target market in Fayetteville by thinking about the types of people who buy things there.

Pricing Strategies to Attract Fayetteville Buyers

To get serious buyers in the Fayetteville market, you need to price your home correctly. It’s important to set the right price for your home so that it sells quickly and for the most money possible. Choosing the right pricing strategy is very important in this competitive market where first-time buyers, military families, and retirees are frequent buyers. Here are some ways to set your prices that will help you get more buyers in Fayetteville:

Price to Compete, Not to Overwhelm

Pricing Your Home Right is a book that will help you find the right price for your Fayetteville home. People who want to buy your home might not even bother to look at it if the price is too high. Your home will stand out if you price it just below the competition. Find similar houses in your area and set a price that will make it competitive with other listings that are for sale. A competitive price gets more people interested and makes it more likely that there will be more than one deal.

Psychological Pricing to Catch Buyers’ Attention

The use of psychological pricing is a strong tactic. It’s not enough to just know numbers when pricing your home; you also need to know how people think about those numbers. For instance, listing your house at $199,900 instead of $200,000 makes it look like a better deal. This way of setting the price of your home tricks the buyer’s mind into thinking it is cheaper than it really is. Many houses in Fayetteville are priced around $200,000. Even small changes like this can have a big effect on buyer interest.

Pricing Below Market Value for a Quick Sale

You could also try selling below what the item is worth on the market. Pricing Your Home Right is sometimes about making people feel like they need to act quickly, which may not make sense. You can make the market more competitive by setting a price just below the market value. This works especially well in Fayetteville, where homes near military bases like Fort Bragg often sell quickly. This could bring in more than one offer, which would help you sell your home faster and maybe even start a bidding war that would drive up the price.

Stay Flexible and Open to Negotiation

It’s important to set a price that people will want to pay, but Pricing Your Home Right also tells you to be willing to negotiate. Many buyers in Fayetteville expect to be able to negotiate, especially when they are looking at homes that might need small fixes or updates. You should be ready to lower your price or make concessions, like paying for the closing costs or giving the buyer a home guarantee. These small changes can improve the value of your home and give buyers the freedom to make an offer.

Leverage Local Trends and Buyer Needs

To Price Your Home Right in Fayetteville, you need to know how the local market is changing. For instance, military families moving to the area may have specific needs, like wanting to be close to Fort Bragg. On the other hand, first-time owners may be looking for homes that don’t need as much upkeep. Based on these buyer needs, change how you set your prices. Your offering may stand out in a crowded market if you offer a home that meets these criteria at a good price.

Evaluating the Right Time to Adjust Your Price

It’s crucial to keep an eye on things and be prepared to change your selling price if necessary when it comes to pricing your home right. The real estate market in Fayetteville is very competitive, so things can change quickly. How you price your home can have a big effect on how well it sells. There are important things you need to know about price changes so that your home doesn’t stay on the market for too long.

Signs That Your Home Is Overpriced

To figure out if you need to lower your price, you must first be able to spot the signs that your home is priced too high. These are some signs to keep an eye out for:

Lack of Inquiries or Showings: If people aren’t interested in buying your home, it could mean that the price you’re asking is too high compared to other homes in Fayetteville that are for sale at the same time.

If You Get No Offers After A Few Weeks: When a house sits on the market for too long without getting an offer, it means that owners think the price is too high.

Similar homes are selling more quickly: Your home probably isn’t moving as quickly as other homes in the same or a nearby Fayetteville area because it’s probably priced too high.

If you see these signs, you might want to change your price to stay competitive and bring in more buyers.

When to Lower the Price

A key component of pricing your home right is knowing when to lower the price. You should be patient, but lowering the price at the right time can help bring new people to your home. Here are some times when you might want to lower the price:

After a Slow Start: If your house has been on the market for a few weeks and hasn’t sold, it might be time to change the price. People will start to wonder why the house hasn’t sold yet, which may cause interest to fade over time.

Market Conditions Change: The home market in Fayetteville can change, especially as the seasons change. In order to stay competitive, you should drop your price if the market is slow or if interest rates are going up.

What buyers and agents have to say: Pay attention to what real estate salespeople and potential buyers have to say. If a lot of buyers say the price is too high for what it’s giving them, it might be time to lower it to meet market standards.

Navigating the Changing Market Conditions

There are many things that can cause Fayetteville’s real estate market to change, such as changes in interest rates, military moves, and the local economy. When these things happen, pricing your home right may call for some wiggle room. If the market shifts in favor of buyers or demand slows down, you may need to change your prices to stay competitive.

Also, keeping up with local trends, like new buildings going up in Fort Bragg or changes in the local economy, can help you figure out how market changes might affect the value of your house.

The Role of a Real Estate Agent in Pricing Your Home

Working with a skilled and experienced Fayetteville real estate agent can make all the difference when it comes to pricing your home right. In the competitive Fayetteville market, a good agent can help you set the right price for your house by using their knowledge of the local market and the industry as a whole.

Why Local Expertise Matters

The fact that real estate agents know the local market so well is one of the best things about working with one. Fayetteville’s housing market is one of a kind because of the military community, its closeness to Fort Bragg, and the way different neighborhoods are set up. In order to ensure that you are pricing your home right based on current trends and neighborhood dynamics, a local real estate agent is familiar with the specific factors that influence buyer interest in Fayetteville.

Agent’s Role in Adjusting Your Pricing Strategy

An experienced agent doesn’t just help you decide on a price to list your home at first; they also keep a close eye on the market and will suggest price changes when they think it’s necessary. If your home isn’t selling as quickly as you thought it would, your agent will look at feedback from showings and market data to come up with smart price changes. Being flexible is important to make sure you don’t miss out on chances and set the right price for your home so it stays competitive in the market.

Utilizing Data and Technology

To correctly figure out how much a home is worth, real estate agents also use high-tech tools and equipment. They can use advanced Comparative Market Analysis (CMA) software to look at recent sales, trends in the area, and the prices of Fayetteville houses that are similar to the one they are looking at. With this information at their fingertips, agents can give you a thorough report that assists you in making educated choices about pricing your home right, making sure it is in line with the current market conditions.

Conclusion

In Fayetteville’s constantly changing housing market, setting the right price for your home is very important. You can make smart choices if you know the specific factors that affect home prices in places like Fort Bragg, Haymount, and Pinehurst. The pricing plan you choose can have a big effect on how quickly and for how much your home sells. This includes things like doing a Comparative Market Analysis (CMA) and looking at home features and demand in the neighborhood.

Remember that Pricing Your Home Right isn’t just about setting a fair price; it’s also about changing your plan based on what the market says and how the seasons change. By paying close attention to how the local market is changing and working with an experienced real estate agent, you can make sure that the price of your home is fair and will attract the right buyers.

Pricing Your Home Right is all about finding the best price—a price that shows how much your home is worth while also setting it up to sell quickly and for the most money possible. To make sure your Fayetteville home sale goes smoothly, be open, learn as much as you can, and talk to local experts.

But it gets better:

You can sell fast without an agent with no rush to move. You don’t have to move out right away; you can stay in your home for awhile until you locate another home.

We are confident that we can help you today – regardless of the situation.